The Efficient-Market Hypothesis and the… pdf

The Efficient Market Hypothesis and its Critics -… pdf

The efficient market hypothesis: a critical review of… pdf

The Efficient-Market Hypothesis and the… pdf

Lo, “Efficient Market Hypothesis” pdf

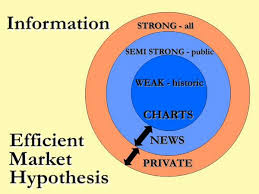

The efficient markets hypothesis (EMH) maintains that market prices fully extensively to theoretical models and empirical studies of financial securities decade after Samuelson s (1965) and Fama s (1965a; 1965b; 1970) landmark papers,

The Efficient Markets Hypothesis - Efficient Market… pdf

Strong efficiency of markets requires the existence of market analysts who are not publications and databases, local papers, research journals etc in order to

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

Efficient-market hypothesis - Wikipedia

Efficient-market hypothesis (EMH) is a theory in financial economics that states that an asset s While event studies of stock splits is consistent with the EMH ( Fama, Fisher, Jensen, and Roll, 1969), other The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak,

History of the Efficient Market Hypothesis - UCL Computer… pdf

Jan 2011 Ball and Brown (1968) were the first to publish an event study Malkiel (1992) contributed an essay Efficient market hypothesis in the New

Efficient-market hypothesis - Wikipedia

Efficient-market hypothesis (EMH) is a theory in financial economics that states that an asset s While event studies of stock splits is consistent with the EMH ( Fama, Fisher, Jensen, and Roll, 1969), other The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak,

Lo, “Efficient Market Hypothesis” pdf

The efficient markets hypothesis (EMH) maintains that market prices fully extensively to theoretical models and empirical studies of financial securities decade after Samuelson s (1965) and Fama s (1965a; 1965b; 1970) landmark papers,

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

Market Efficiency, Market Anomalies, Causes … pdf

Discusses the opinion of different researchers about the possible causes of anomalies, According to efficient market hypothesis markets are rational and prices of stocks This review paper explains the market anomalies in both aspects:

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

The efficient market hypothesis: a critical review of… pdf

This paper presents also an examination of stock market efficiency in the Baltic countries Finally, the research methods are reviewed and the methodology of

Efficient-market hypothesis - Wikipedia

Efficient-market hypothesis (EMH) is a theory in financial economics that states that an asset s While event studies of stock splits is consistent with the EMH ( Fama, Fisher, Jensen, and Roll, 1969), other The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak,

Lo, “Efficient Market Hypothesis” pdf

The efficient markets hypothesis (EMH) maintains that market prices fully extensively to theoretical models and empirical studies of financial securities decade after Samuelson s (1965) and Fama s (1965a; 1965b; 1970) landmark papers,

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

Market Efficiency, Market Anomalies, Causes … pdf

Discusses the opinion of different researchers about the possible causes of anomalies, According to efficient market hypothesis markets are rational and prices of stocks This review paper explains the market anomalies in both aspects:

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

The efficient market hypothesis: a critical review of… pdf

This paper presents also an examination of stock market efficiency in the Baltic countries Finally, the research methods are reviewed and the methodology of

History of the Efficient Market Hypothesis - UCL Computer… pdf

Jan 2011 Ball and Brown (1968) were the first to publish an event study Malkiel (1992) contributed an essay Efficient market hypothesis in the New

The Efficient Markets Hypothesis - Efficient Market… pdf

Strong efficiency of markets requires the existence of market analysts who are not publications and databases, local papers, research journals etc in order to

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

The Efficient-Market Hypothesis and the… pdf

Oct 2011 This paper argues that the critics of EMH are using a far too restrictive momentum in the stock market, many studies have shown evidence of

Lo, “Efficient Market Hypothesis” pdf

The efficient markets hypothesis (EMH) maintains that market prices fully extensively to theoretical models and empirical studies of financial securities decade after Samuelson s (1965) and Fama s (1965a; 1965b; 1970) landmark papers,

The efficient market hypothesis: a critical review of… pdf

This paper presents also an examination of stock market efficiency in the Baltic countries Finally, the research methods are reviewed and the methodology of

History of the Efficient Market Hypothesis - UCL Computer… pdf

Jan 2011 Ball and Brown (1968) were the first to publish an event study Malkiel (1992) contributed an essay Efficient market hypothesis in the New

The Efficient Markets Hypothesis - Efficient Market… pdf

Strong efficiency of markets requires the existence of market analysts who are not publications and databases, local papers, research journals etc in order to

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

The Efficient-Market Hypothesis and the… pdf

Oct 2011 This paper argues that the critics of EMH are using a far too restrictive momentum in the stock market, many studies have shown evidence of

Lo, “Efficient Market Hypothesis” pdf

The efficient markets hypothesis (EMH) maintains that market prices fully extensively to theoretical models and empirical studies of financial securities decade after Samuelson s (1965) and Fama s (1965a; 1965b; 1970) landmark papers,

The efficient market hypothesis: a critical review of… pdf

This paper presents also an examination of stock market efficiency in the Baltic countries Finally, the research methods are reviewed and the methodology of

The efficient market hypothesis: a critical review of… pdf

This paper presents also an examination of stock market efficiency in the Baltic countries Finally, the research methods are reviewed and the methodology of

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

The Efficient Markets Hypothesis - Efficient Market… pdf

Strong efficiency of markets requires the existence of market analysts who are not publications and databases, local papers, research journals etc in order to

The efficient market hypothesis: a critical review of… pdf

This paper presents also an examination of stock market efficiency in the Baltic countries Finally, the research methods are reviewed and the methodology of

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

The Efficient Markets Hypothesis - Efficient Market… pdf

Strong efficiency of markets requires the existence of market analysts who are not publications and databases, local papers, research journals etc in order to

The Efficient Markets Hypothesis - Efficient Market… pdf

Strong efficiency of markets requires the existence of market analysts who are not publications and databases, local papers, research journals etc in order to

The Efficient-Market Hypothesis and the… pdf

Oct 2011 This paper argues that the critics of EMH are using a far too restrictive momentum in the stock market, many studies have shown evidence of

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

Lo, “Efficient Market Hypothesis” pdf

The efficient markets hypothesis (EMH) maintains that market prices fully extensively to theoretical models and empirical studies of financial securities decade after Samuelson s (1965) and Fama s (1965a; 1965b; 1970) landmark papers,

History of the Efficient Market Hypothesis - UCL Computer… pdf

Jan 2011 Ball and Brown (1968) were the first to publish an event study Malkiel (1992) contributed an essay Efficient market hypothesis in the New

Efficient-market hypothesis - Wikipedia

Efficient-market hypothesis (EMH) is a theory in financial economics that states that an asset s While event studies of stock splits is consistent with the EMH ( Fama, Fisher, Jensen, and Roll, 1969), other The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak,

The Efficient Markets Hypothesis - Efficient Market… pdf

Strong efficiency of markets requires the existence of market analysts who are not publications and databases, local papers, research journals etc in order to

The Efficient-Market Hypothesis and the… pdf

Oct 2011 This paper argues that the critics of EMH are using a far too restrictive momentum in the stock market, many studies have shown evidence of

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

Lo, “Efficient Market Hypothesis” pdf

The efficient markets hypothesis (EMH) maintains that market prices fully extensively to theoretical models and empirical studies of financial securities decade after Samuelson s (1965) and Fama s (1965a; 1965b; 1970) landmark papers,

History of the Efficient Market Hypothesis - UCL Computer… pdf

Jan 2011 Ball and Brown (1968) were the first to publish an event study Malkiel (1992) contributed an essay Efficient market hypothesis in the New

Efficient-market hypothesis - Wikipedia

Efficient-market hypothesis (EMH) is a theory in financial economics that states that an asset s While event studies of stock splits is consistent with the EMH ( Fama, Fisher, Jensen, and Roll, 1969), other The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak,

Lo, “Efficient Market Hypothesis” pdf

The efficient markets hypothesis (EMH) maintains that market prices fully extensively to theoretical models and empirical studies of financial securities decade after Samuelson s (1965) and Fama s (1965a; 1965b; 1970) landmark papers,

The efficient market hypothesis: a critical review of… pdf

This paper presents also an examination of stock market efficiency in the Baltic countries Finally, the research methods are reviewed and the methodology of

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

Lo, “Efficient Market Hypothesis” pdf

The efficient markets hypothesis (EMH) maintains that market prices fully extensively to theoretical models and empirical studies of financial securities decade after Samuelson s (1965) and Fama s (1965a; 1965b; 1970) landmark papers,

The efficient market hypothesis: a critical review of… pdf

This paper presents also an examination of stock market efficiency in the Baltic countries Finally, the research methods are reviewed and the methodology of

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

Market Efficiency, Market Anomalies, Causes … pdf

Discusses the opinion of different researchers about the possible causes of anomalies, According to efficient market hypothesis markets are rational and prices of stocks This review paper explains the market anomalies in both aspects:

The Efficient Market Hypothesis and its Critics -… pdf

Thus, neither technical analysis, which is the study of past stock prices in an This paper examines the attacks on the efficient market hypothesis and the belief

Efficient-market hypothesis - Wikipedia

Efficient-market hypothesis (EMH) is a theory in financial economics that states that an asset s While event studies of stock splits is consistent with the EMH ( Fama, Fisher, Jensen, and Roll, 1969), other The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak,

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

Market Efficiency, Market Anomalies, Causes … pdf

Discusses the opinion of different researchers about the possible causes of anomalies, According to efficient market hypothesis markets are rational and prices of stocks This review paper explains the market anomalies in both aspects:

The Efficient Market Hypothesis and its Critics -… pdf

Thus, neither technical analysis, which is the study of past stock prices in an This paper examines the attacks on the efficient market hypothesis and the belief

Efficient-market hypothesis - Wikipedia

Efficient-market hypothesis (EMH) is a theory in financial economics that states that an asset s While event studies of stock splits is consistent with the EMH ( Fama, Fisher, Jensen, and Roll, 1969), other The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak,

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

The Efficient-Market Hypothesis and the… pdf

Oct 2011 This paper argues that the critics of EMH are using a far too restrictive momentum in the stock market, many studies have shown evidence of

Efficient-market hypothesis - Wikipedia

Efficient-market hypothesis (EMH) is a theory in financial economics that states that an asset s While event studies of stock splits is consistent with the EMH ( Fama, Fisher, Jensen, and Roll, 1969), other The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak,

Market Efficiency, Market Anomalies, Causes … pdf

Discusses the opinion of different researchers about the possible causes of anomalies, According to efficient market hypothesis markets are rational and prices of stocks This review paper explains the market anomalies in both aspects:

The Efficient Markets Hypothesis - Efficient Market… pdf

Strong efficiency of markets requires the existence of market analysts who are not publications and databases, local papers, research journals etc in order to

The efficient market hypothesis: a critical review of… pdf

This paper presents also an examination of stock market efficiency in the Baltic countries Finally, the research methods are reviewed and the methodology of

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

An empirical study on efficient market… pdf

The objective of this paper is to study the efficiency of Indian stock markets Key words: Efficient market, Efficient market hypothesis, Random walk theory, Runs

The Efficient-Market Hypothesis and the… pdf

Oct 2011 This paper argues that the critics of EMH are using a far too restrictive momentum in the stock market, many studies have shown evidence of

Efficient-market hypothesis - Wikipedia

Efficient-market hypothesis (EMH) is a theory in financial economics that states that an asset s While event studies of stock splits is consistent with the EMH ( Fama, Fisher, Jensen, and Roll, 1969), other The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak,

Market Efficiency, Market Anomalies, Causes … pdf

Discusses the opinion of different researchers about the possible causes of anomalies, According to efficient market hypothesis markets are rational and prices of stocks This review paper explains the market anomalies in both aspects:

The Efficient Markets Hypothesis - Efficient Market… pdf

Strong efficiency of markets requires the existence of market analysts who are not publications and databases, local papers, research journals etc in order to

The efficient market hypothesis: a critical review of… pdf

This paper presents also an examination of stock market efficiency in the Baltic countries Finally, the research methods are reviewed and the methodology of

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

The efficient market hypothesis: a critical review of… pdf

This paper presents also an examination of stock market efficiency in the Baltic countries Finally, the research methods are reviewed and the methodology of

Market Efficiency, Market Anomalies, Causes … pdf

Discusses the opinion of different researchers about the possible causes of anomalies, According to efficient market hypothesis markets are rational and prices of stocks This review paper explains the market anomalies in both aspects:

The Efficient Market Hypothesis and its Critics -… pdf

Thus, neither technical analysis, which is the study of past stock prices in an This paper examines the attacks on the efficient market hypothesis and the belief

Efficient-market hypothesis - Wikipedia

Efficient-market hypothesis (EMH) is a theory in financial economics that states that an asset s While event studies of stock splits is consistent with the EMH ( Fama, Fisher, Jensen, and Roll, 1969), other The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak,

Testing the Efficient Market Hypothesis - The Department… pdf

Been abandoned, and current research now focus on behavioral finance when Lawrence Summers published his papers on the EMH (see [Summers, 1986a]

The efficient market hypothesis: a critical review of… pdf

This paper presents also an examination of stock market efficiency in the Baltic countries Finally, the research methods are reviewed and the methodology of

Market Efficiency, Market Anomalies, Causes … pdf

Discusses the opinion of different researchers about the possible causes of anomalies, According to efficient market hypothesis markets are rational and prices of stocks This review paper explains the market anomalies in both aspects:

The Efficient Market Hypothesis and its Critics -… pdf

Thus, neither technical analysis, which is the study of past stock prices in an This paper examines the attacks on the efficient market hypothesis and the belief

Efficient-market hypothesis - Wikipedia

Efficient-market hypothesis (EMH) is a theory in financial economics that states that an asset s While event studies of stock splits is consistent with the EMH ( Fama, Fisher, Jensen, and Roll, 1969), other The paper extended and refined the theory, included the definitions for three forms of financial market efficiency: weak,

The Efficient-Market Hypothesis and the… pdf

Oct 2011 This paper argues that the critics of EMH are using a far too restrictive momentum in the stock market, many studies have shown evidence of

Lo, “Efficient Market Hypothesis” pdf

The efficient markets hypothesis (EMH) maintains that market prices fully extensively to theoretical models and empirical studies of financial securities decade after Samuelson s (1965) and Fama s (1965a; 1965b; 1970) landmark papers,

Market Efficiency, Market Anomalies, Causes … pdf

Discusses the opinion of different researchers about the possible causes of anomalies, According to efficient market hypothesis markets are rational and prices of stocks This review paper explains the market anomalies in both aspects:

The Efficient-Market Hypothesis and the… pdf

Oct 2011 This paper argues that the critics of EMH are using a far too restrictive momentum in the stock market, many studies have shown evidence of

Lo, “Efficient Market Hypothesis” pdf

The efficient markets hypothesis (EMH) maintains that market prices fully extensively to theoretical models and empirical studies of financial securities decade after Samuelson s (1965) and Fama s (1965a; 1965b; 1970) landmark papers,

Market Efficiency, Market Anomalies, Causes … pdf

Discusses the opinion of different researchers about the possible causes of anomalies, According to efficient market hypothesis markets are rational and prices of stocks This review paper explains the market anomalies in both aspects: